Search our articles

Can Vietnam sustain its rapid economic growth?

Key Insights:

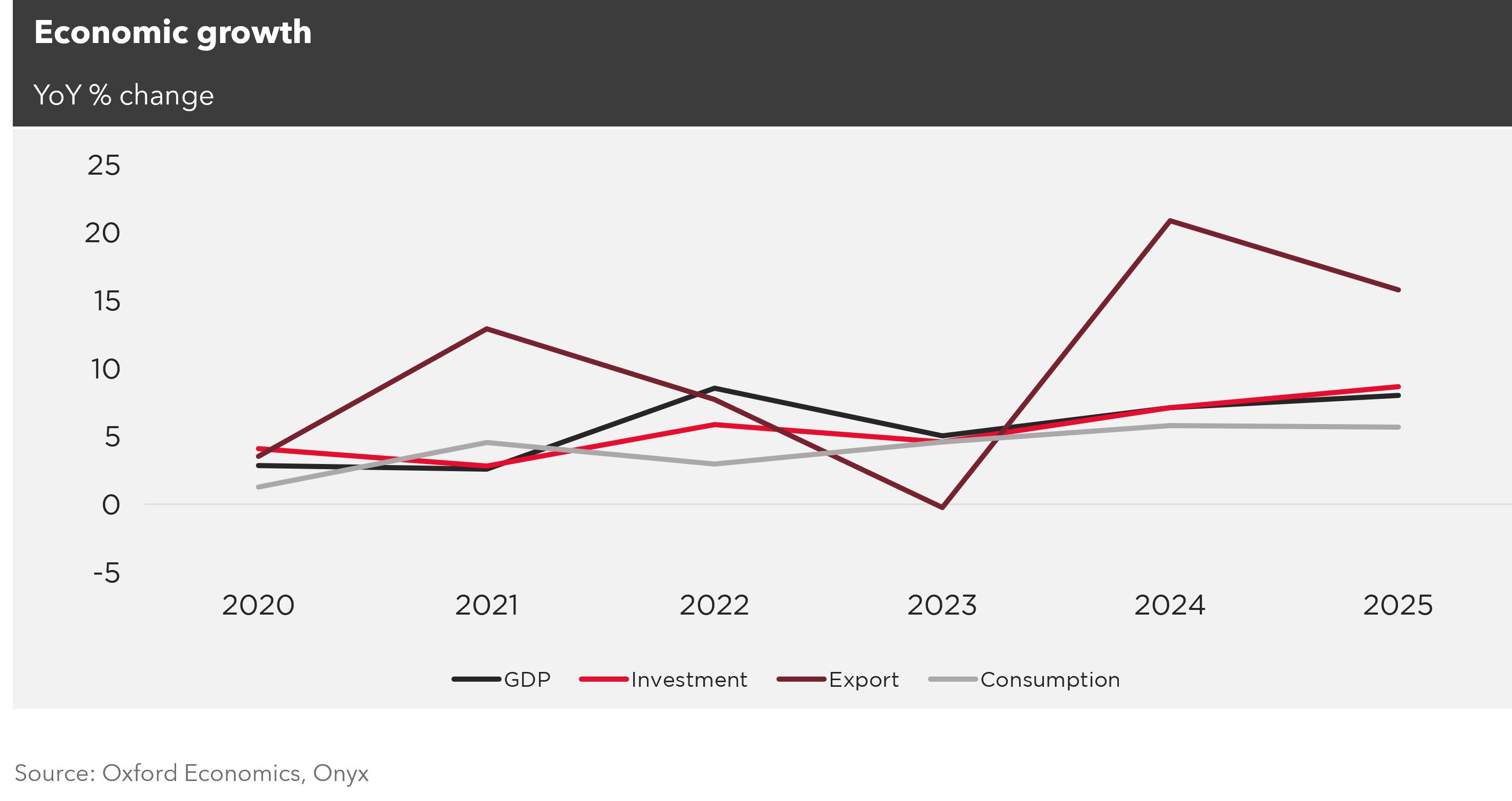

What is happening: Vietnam recorded robust GDP growth of around 8%, driven by strong export performance and elevated infrastructure spending. To sustain this momentum, the government plans to increase public sector investment by roughly 26%, prioritizing logistics and power infrastructure, alongside initiatives to raise labor productivity through workforce upskilling.

Why it matters: Infrastructure bottlenecks and a tight labor market have been among the most persistent operational challenges for businesses in Vietnam. The government’s emphasis on expanding infrastructure capacity and improving labor productivity directly addresses these constraints and is broadly welcomed by industry players.

What happens next: Despite the positive policy direction, rising production costs linked to labor shortages remain a key risk and could weigh on growth. Moreover, while the infrastructure push is ambitious, execution risks are material, as limited fiscal space may constrain the government’s ability to deliver projects on schedule.

Vietnam’s growth engine shifts into a higher gear

Vietnam has entered a strong growth phase, recording GDP expansion of around 8%, supported by resilient exports and a renewed push in public investment. Manufacturing exports—particularly electronics, machinery, and consumer goods—continue to anchor growth, while the government is signaling a clear commitment to sustaining economic momentum through fiscal support.

A key pillar of this strategy is a planned 26% increase in public sector investment, with spending directed primarily toward logistics and power infrastructure. Upgrades to ports, roads, and industrial connectivity are intended to ease supply chain bottlenecks and support Vietnam’s expanding role in global manufacturing networks. At the same time, the government is placing greater emphasis on improving labor productivity through workforce upskilling programs, reflecting concerns that labor availability and skill mismatches could become binding constraints as the economy matures.

Addressing the bottlenecks businesses feel most

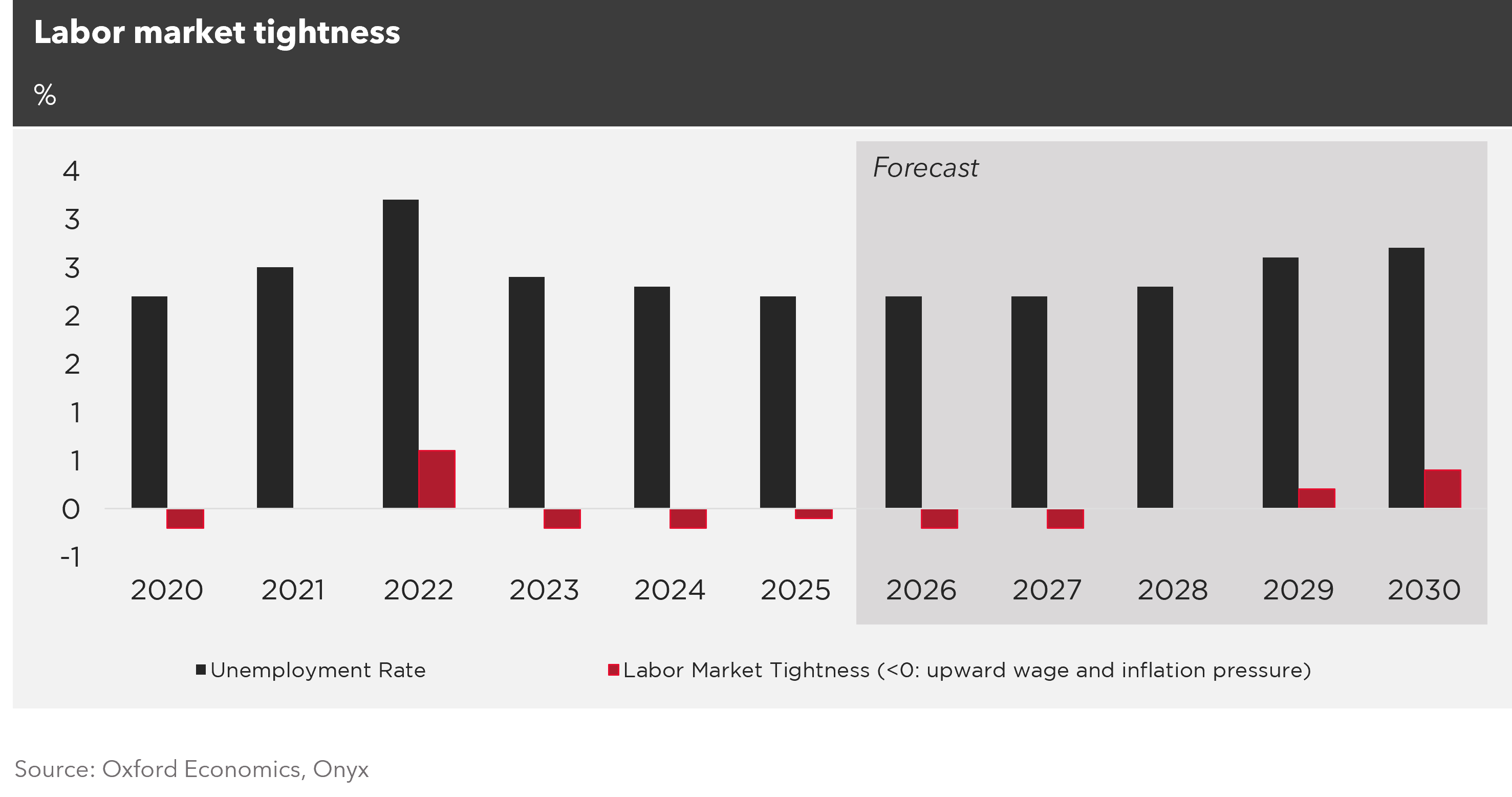

For businesses operating in Vietnam, infrastructure gaps and a tightening labor market have consistently ranked among the top operational challenges. Congestion at ports, uneven power reliability in certain regions, and rising competition for skilled workers have increased costs and reduced flexibility for manufacturers and logistics-dependent industries.

The government’s focus on infrastructure expansion directly targets these pressure points. Improved logistics efficiency can lower transportation costs, reduce lead times, and enhance Vietnam’s attractiveness as a regional manufacturing and export hub. Similarly, investments in workforce upskilling are critical as companies move toward higher-value production that requires more technical capabilities.

Looking ahead: execution risks loom despite strong policy signals

Despite the positive direction of policy, risks remain. A tight labor market continues to push up wages and production costs, which could gradually erode Vietnam’s cost competitiveness if productivity gains do not keep pace. For labor-intensive sectors in particular, this dynamic may constrain expansion plans or accelerate automation decisions.

Execution risk is another key concern. While the infrastructure investment plan is ambitious, Vietnam’s limited fiscal space raises questions about how quickly projects can be financed and delivered. Delays in implementation could blunt the near-term impact of public investment and weigh on business confidence.

Looking ahead, Vietnam’s growth trajectory will hinge on whether it can translate policy ambition into timely execution—balancing fiscal discipline with the need to unlock infrastructure capacity and sustain productivity-led growth.

Topics: Southeast Asia, Labor, Industrial, Infrastructure, Economy, Manufacturing, Export

Written by Onyx Strategic Insights