Search our articles

“Transshipment” may reshape access to the US market

Key Insights:

What happened: The Trump administration issued a tariff of 40% on goods deemed by CBP to have been transshipped. This 40% tariff took effect on August 7, yet implementation remains unclear because the CBP has not defined what constitutes transshipment.

Why it matters: How expansive the CBP’s definition of transshipment determines the level of disruption to existing manufacturing supply chains, particularly in Asia. Even a more conservative application of the 40% tariff to the Chinese content in exports to the US will erode the benefits of the friendshoring model.

What happens next: Supply chain teams will need to closely monitor how CBP applies the transshipment tariffs. US trading partners will likely pre-empt this tariff by seeking to limit the amount of Chinese content of goods bound for the US.

ANALYSIS

On July 31, President Donald Trump issued a tariff of 40% on goods deemed by the US Customs and Border Protection (CBP) to have been transshipped, on top of existing duties. This 40% tariff took effect on August 7, yet implementation remains unclear because the CBP has not defined what constitutes transshipment. In the absence of a clear definition, the administration has leaned on deterrence, pledging to publish a list of countries and facilities used in circumvention schemes every six months. The tariff is meant to impact non-market economies and is widely believed to be aimed at curbing Chinese exports more specifically.

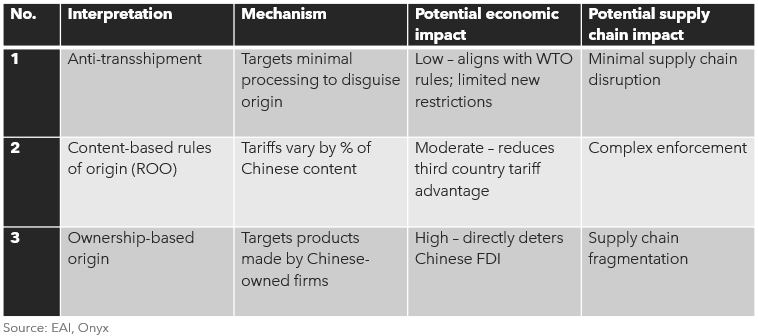

There are three possible definitions, stemming from existing WTO proposals and US official statements, (see Table 1) that entail different supply chain risks levels for multinationals producing elsewhere and shipping to the US.

Table 1

The most far-reaching and disruptive definition is if CBP targets products made by Chinese-owned or domiciled firms. This directly deters incoming Chinese FDI in US trading partners and complicates existing investments in production capacity there. Applying a 40% tariff to these inputs would likely result in a fragmentation of manufacturing supply chains in Southeast Asia and East Asia.

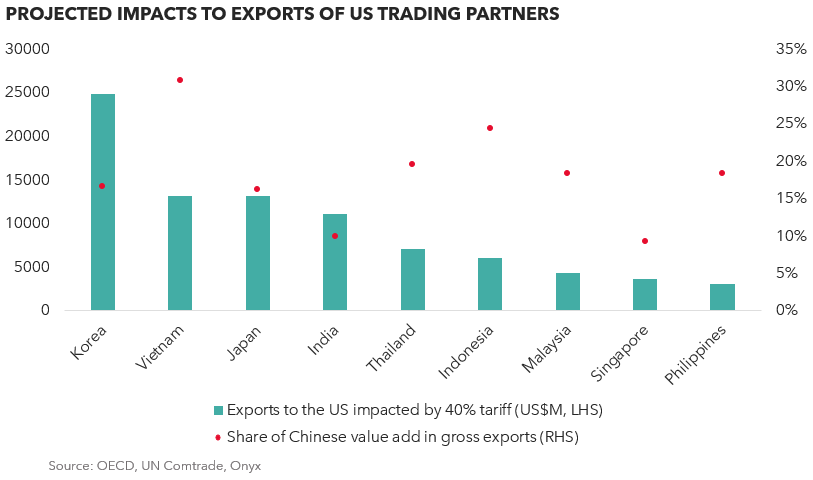

In contrast, if the administration applies the 40% tariff on the amount of Chinese content in exports to the US, the tariff advantage of firms who relocated production out of China to a third country would be reduced but effects would vary. To determine impacts in Scenario 2, we take China’s foreign value add in a country’s gross exports and multiply it by the value of total exports to the US to derive a simple estimate of the amount of Chinese content that would face transshipment tariffs. We find that the top three impacted countries are Korea, Vietnam, and Japan, due to a combination of their greater volume of exports to the US and a high amount of Chinese value add in their overall exports (see Figure 1).

As the latest available data for China’s value add in gross exports are in 2018, we believe the scale of impact would be higher in 2025 and beyond, given the rapid growth of Chinese intermediates in global production chains in recent years. Moreover, sectors like electronics, batteries, and new energy would be far more exposed to the transshipment tariff.

Figure 1

How expansive the definition of transshipment that the CBP decides on will determine the level of disruption to existing manufacturing supply chains. Even a more conservative application of the 40% tariff to the Chinese content in exports to the US will erode the benefits of the friendshoring model that many US firms have opted for, particularly over the last 5 years.

Topics: South Asia, Southeast Asia, Trade, Manufacturing, Economy

Written by Onyx Strategic Insights