Search our articles

The tariff lag: why April's tariffs signal an inflationary summer

Key Insights:

- What is Happening: U.S. tariffs announced April 2nd are expected to begin elevating consumer prices from June/July. While an initial inventory absorption period has muted immediate inflationary effects thus far, leading indicators and business communications now suggest the pass-through of these tariff-related costs is imminent.

- Why It Matters: This projected tariff pass-through signifies higher costs for both consumers and businesses, potentially exacerbating broader inflationary pressures. Growing consumer inflation expectations and reactions in financial markets, like rising long-term bond yields, underscore concerns about the impact on economic stability.

- What Happens Next: Inflation data from June through August will be crucial, likely revealing accelerating price increases as tariff impacts become more widespread. Consumers should anticipate higher costs on various goods, and policymakers must closely monitor these trends for their broader economic implications.

ANALYSIS

A critical economic question currently revolves around the U.S. tariffs announced on April 2, 2025: when will their inflationary impact materialize in consumer prices?

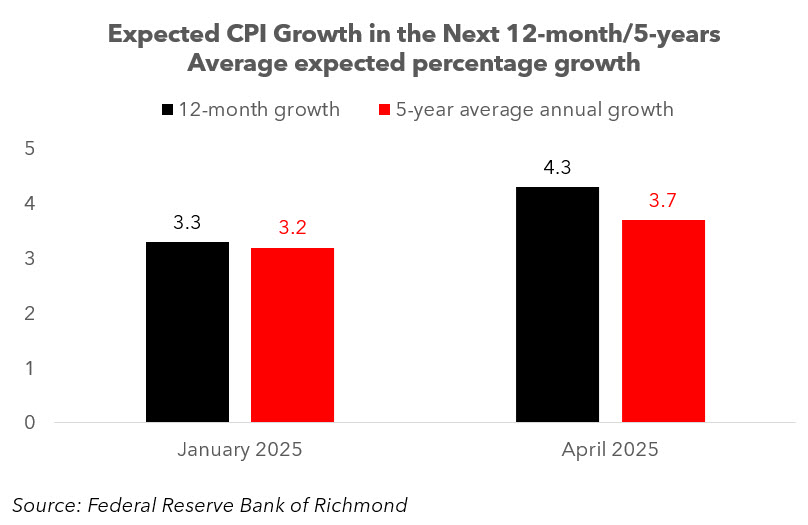

While headline inflation has been relatively contained post-announcement, this calm may be deceptive. Recent survey data, for example, indicate a sharp rise in consumer expectations for future inflation (as noted by the Federal Reserve Bank of New York's April 2025 Survey of Consumer Expectations, showing mixed but elevated short and medium-term concerns). Furthermore, a noticeable increase in long-term bond yields suggests financial markets are also bracing for higher inflation.

This market sentiment appears to be driven by a combination of factors, including the anticipated pass-through of tariff costs and concerns over an expanding federal deficit, potentially exacerbated by the latest tax bill proposal recently passed by the House. These converging signals suggest that a tariff-induced inflationary impact is likely imminent, potentially beginning in June and gathering momentum through July and August.

The underlying economic principle is clear: tariffs function as a tax on imported goods. When the cost to import increases, businesses across the supply chain face a critical decision. While some level of cost absorption can occur, especially with minor or short-lived tariffs, significant and broad-based tariffs like those recently enacted are rarely fully absorbed by businesses at the expense of their margins. Ultimately, these increased costs tend to cascade through the supply chain, culminating in higher prices for consumers.

“Given the April 2nd tariff announcement date, a standard inventory burn-down period squarely positions June and July as the likely inflection point for broader price impacts.”

—

A key factor in this transmission is the inherent lag caused by inventory cycles, typically estimated at two to three months, varying by industry. Companies usually maintain a certain stock of goods. Following the imposition of new tariffs, they first utilize existing, pre-tariff inventory. This buffer temporarily shields consumers from immediate price hikes. However, as these reserves are depleted and businesses restock at higher, tariff-inclusive prices, the impetus to raise consumer-facing prices becomes compelling.

Given the April 2nd tariff announcement date, a standard inventory burn-down period squarely positions June and July as the likely inflection point for broader price impacts. This timeline is corroborated by emerging business sentiment. For instance, a Q1 2025 survey from the Richmond Fed noted in Q1 2025 that a growing number of firms identified trade and tariffs as a primary concern.

More recently, prominent retailers have begun to signal the pass-through of tariff costs. Walmart executives, for example, stated in mid-May 2025 that while they aim to keep prices low, the magnitude of the current tariffs makes it challenging to absorb all the pressure, implying that consumers will likely see price increases in the coming weeks. While some other large retailers, like Home Depot, have indicated strategies to mitigate these price hikes through supply chain diversification, the broad expectation across much of the retail sector is that higher tariff-related costs will soon translate to consumer prices.

Empirical research from past tariff episodes validates this lagged pass-through. Influential studies, such as those by Amiti, Redding, and Weinstein (2020) on the 2018-2019 tariffs, have demonstrated that U.S. firms and consumers ultimately bear the brunt of these import duties. Research by Fajgelbaum et al. (2019) similarly found complete pass-through of U.S. tariffs to import prices, leading to significant costs for consumers and producers. Further work by Cavallo et al. (2021) detailed how tariff impacts are observed at both the border and, with some variation, at the retail level. Federal Reserve analyses, including recent notes such as "Detecting Tariff Effects on Consumer Prices in Real Time", often indicate that tariff effects can surface in consumer prices within a couple of months. Tom Barkin, President of the Richmond Fed, has also highlighted this lag, noting that businesses often hold 30-60 day inventories, pushing price impacts to around June for tariffs announced in April.

More specific to our current situation, analyses of new tariff rates paints a concerning picture. The Budget Lab at Yale University, for instance, estimated tariff rates effective as of May 12 could lead to a noticeable increase in the overall price level in the short-run, potentially by as much as 1.7% (pushing overall inflation above 4%). Their past work also highlights that certain sectors like apparel and automotive, could see even steeper price hikes. Our own modeling comes to a similar conclusion.

The initial period of muted inflation following tariff announcements often reflects the temporary cushioning effect of existing inventories. As summer approaches, the lagged effects of the April tariffs are poised to become increasingly evident in official inflation metrics. This outlook calls for prudent observation and preparedness from businesses, consumers and policymakers alike, as these cost-push pressures could significantly influence the economic landscape in the months ahead. The forthcoming inflation data will be crucial in gauging the full extent of this anticipated price acceleration.

Topics: North America, Trade, Economy

Written by Onyx Strategic Insights