Search our articles

The Pfizer deal previews Trump’s industrial policy

Key Insights:

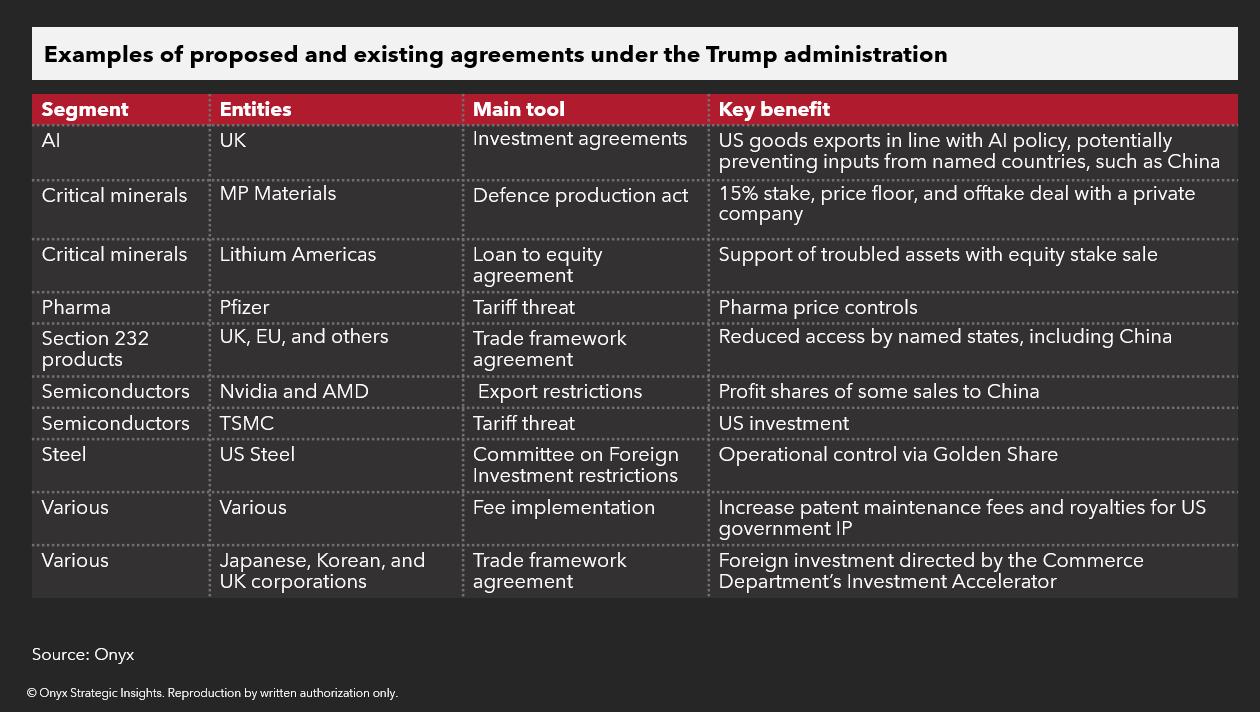

What is happening: The Trump administration is seeking to make deals with companies in 20-30 critical sectors according to reporting by Reuters.

Why it matters: The administration is acting decisively to direct decisions by firms in strategic sectors to support its varied policy goals. This represents a shift away from existing methods such as regulations, incentives, and controls. These state-driven agreements seek to have wide-ranging impact on major sectors of the economy and will directly impact a critical inputs.

What happens next: The administration will target additional segments seeking security, price, and local production guarantees. As the administration seeks deals with dozens of companies, it must also sharpen several of its tools.

President Donald Trump’s tariff policies, tax cuts, and deregulation push were set to have ambiguous impacts on investment within the US. Recent agreements along with this most recent reporting reveal a more comprehensive, if untested, industrial policy.

The Trump administration’s use of ad hoc agreements instead of standardized policy approaches speeds implementation and avoids broad regulation but also raises legal and constitutional questions. As companies await the results on the Supreme Court’s upcoming hearing on the legality of many of the Trump administrations tariffs, this approach is notable as may help shield policies from being overturned by a single court ruling.

Policy goals at the forefront

Only a handful of these sectors have been identified, but the Trump administration’s diverse policy goals are reflected in its deals to date. Critical minerals are receiving significant attention in the wake of China’s supply cut as the Trump administration takes a strategic pause in negotiations with China to ramp up mineral production and purchases. US efforts to improve resilience in critical minerals will directly impact automotive, high-tech, and national defense segments.

As the US is introducing its new industrial strategy, it is also preparing to unveil its National Defense Strategy, which will reportedly shift focus to the Western Hemisphere and domestic issues. Despite this change, efforts to exclude China from supply chains and pursue strategic decoupling remain and Onyx anticipates that national security will be central to negotiations. This focus can significantly reduce input options for companies and drive up the cost of production, among other potential impacts.

Expanding and sharpening the toolset

Looking ahead, several of the Trump administration’s key tools are set to be modernized. First, the Defense Production Act (DPA) allows the use of grants to fill gaps and advance the US industrial base to support defense readiness. Its increasing use since the COVID-19 pandemic and the expanding boundaries of “national security” make it a key tool for industrial policy. The DPA is set for renewal, but it is likely to see reforms with proposals including efforts to improve effectiveness and to alter control structures, such as placing the DPA under the Department of War. The DPA

The Trump administration is also looking to the International Development Finance Corporation (DFC) to be a major source of capital, but it is set to expire this month. Efforts are underway in Congress to reauthorize and dramatically expand its remit. This includes a quadrupling of its portfolio cap to $250 billion, focusing its efforts more directly on strategic interests, and other modifications.

Topics: North America, Industrial, National Security, Manufacturing, Nearshoring, Economy

Written by Onyx Strategic Insights