Search our articles

The "One Big Beautiful Bill" (OBBB) supports the 2026 US outlook, but is the optimism for a capex boom premature?

Key Insights:

The realist case for capex in 2026:

- The Pull-Forward Effect: Some of the capital benefit is retrospective. The bill rewards capex already deployed in early 2025, strengthening balance sheets without necessarily incentivizing new projects for 2026. While the bill could pull some 2027 spend forward, this will likely be marginal—driven by tax optimization rather than a fundamental need for capacity. History suggests these policy measures often pay companies for activity they were planning anyway, rather than adding to the total capital stock.

- Policy Uncertainty: Even with signed legislation, the "rules of the road" regarding tariffs remain volatile. Companies generally don't greenlight multi-year projects when input costs and regulatory frameworks are in flux, unless positive demand signals are overwhelming.

- The AI Capex Reality Check: AI was the primary source of capex growth in 2025. The sector is now transitioning from the "FOMO" phase to the "ROI" phase. As scrutiny on returns tightens—and physical power constraints hit data center build-outs—AI-related capex growth is poised to decelerate, adding less to GDP than in previous years.

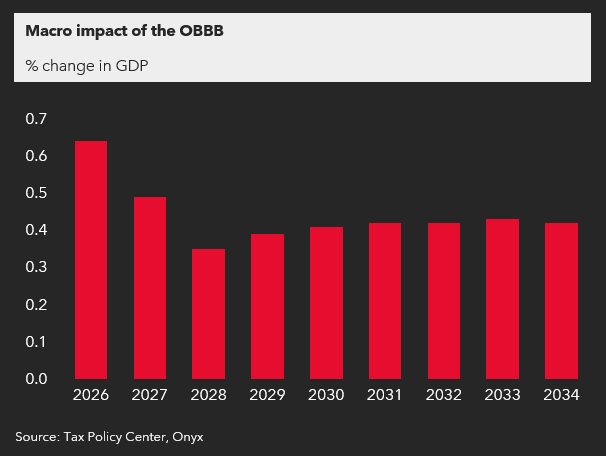

- Debt Overhang: As others have noted, the OBBB adds to the debt-to-GDP ratio, creating potential fiscal drag over the medium to long term.

Through the eyes of a CFO: A lower cost of capital is helpful, and expensing can pull forward demand. But these are rarely the deciding factors for expanding capacity. Real investment models are driven by demand growth and existing capacity constraints. Simply put: if expansion is profitable, companies will pursue it. Taxes and WACC tend to influence timing, location, and financing structures, but they only impact net capital stock additions on the margins.

Our take: Crucially, the OBBB is a supply-side solution to a demand-side problem. With global industrial over-capacity and demand uncertainty still unresolved, cheaper capital doesn't automatically trigger expansion. You don't build a new factory just because the tax rate dropped if your existing plants are not fully utilized and you’re unsure about demand.

The likely result? We borrow from 2027 to support 2026 growth.

Topics: United States, Tax, Fiscal, Investment, Economy

Written by Onyx Strategic Insights