Search our articles

System, interrupted – The Onyx 2026 Outlook

Key Insights:

What is happening: 2026 is a year in which countries are attempting to hold onto key economic drivers and relationships that have been central to their policy under the old international system. At the same time, the moment demands countries begin to shift and position for the next phase.

Why it matters: For companies, the disruption of the moment will continue to drive costs higher, make risks more acute, and hinder strategic decisions. Government policy will be a major driver of risk as countries and blocs attempt to navigate the difficult moment.

What happens next: Policy intentions will clash heavily with the realities of balancing opposing needs and will increasingly force the hands of companies and countries. In 2026, Onyx expects these contradictions to become starkly visible, laying the groundwork for more drastic shifts in the future.

ANALYSIS

This past year marked a tumultuous new macroeconomic phase. Slow-developing trends were rapidly accelerated by US-driven shifts in the global economy, and looking ahead to 2026, the consequences are in full swing. The system of globalized supply chains faces unprecedented disruption. In 2026, it is being reframed and remodeled, resulting in low certainty, high costs, and broad policy risk for companies navigating the shift.

We are entering a year in which state-level policy contradictions are both common and necessary, as countries attempt to maintain untenable niches in a rapidly shifting ecology to buy time. Each of the major centers of consumption and production face distinct hurdles in 2026:

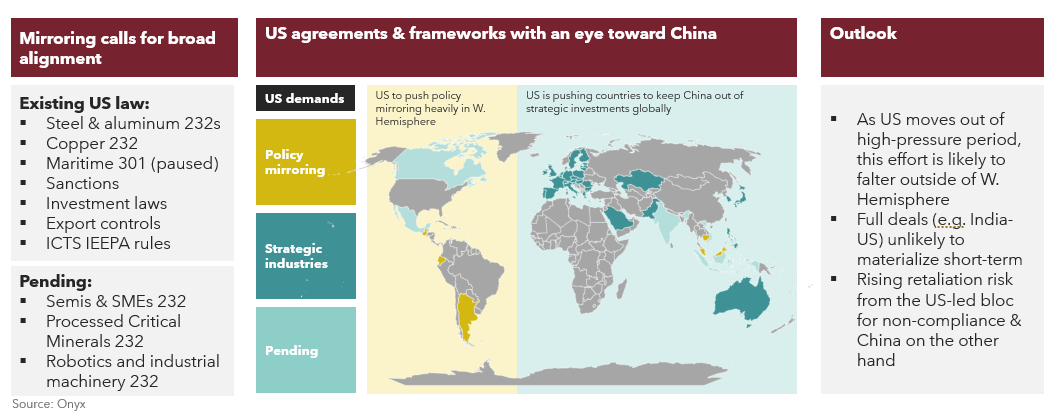

The US is attempting to carry out systemic shifts to attract foreign investment, drive down imports, and manage fiscal deficits with tariffs. These goals are incompatible. With limited political bandwidth – made more acute by the possibility of a cyclical downturn in 2026 – the US is likely to increase debt/GDP even as the risks of a debt crisis rise. Its efforts to drive investment will become a key focus, but with only sector-specific success.

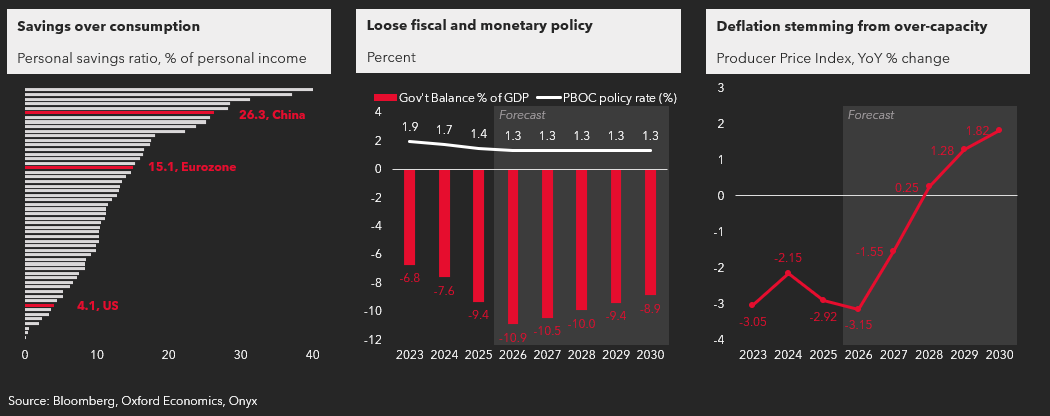

China’s long-term focus on security and productive self-sufficiency remains at the forefront of its policy as the US-China geostrategic competition is now in the open and escalating. While China continues to focus on production, it must continue to rely on the rest of the world for consumption as a turn towards domestic consumption remains off the table in 2026 due to fiscal and political constraints. The overall ability of the Chinese economy to maintain this imbalance is therefore heavily dependent on how other economies react to its exports in 2026 and beyond.

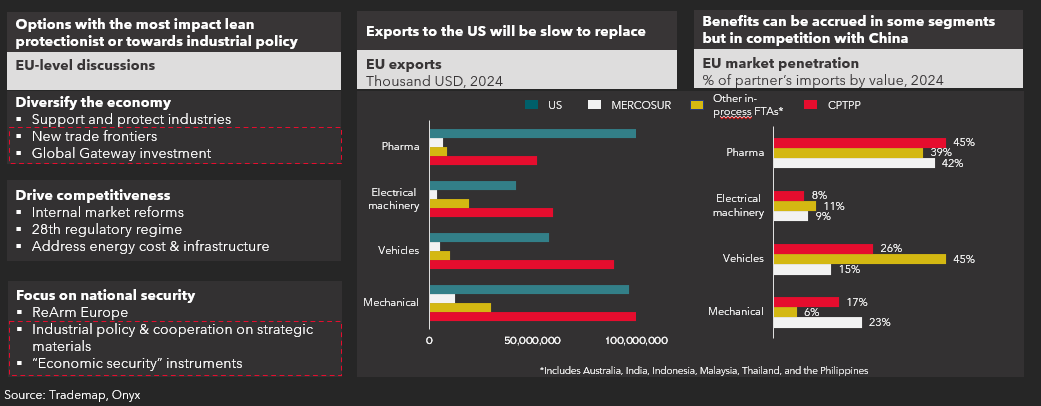

The EU remains in a precarious position. While it wishes to protect the global rules-based trade system it benefits from, the bloc risks being diminished by rising global over-capacity. In 2026, expect a dual-track approach of free trade but with exceptions. Whether the EU is pushed decidedly into protectionism vis-a-vis China remains an open question. Internal divisions and political realities make this unlikely in the short run, but this and other contradictions are unsustainable over time.

Sourcing countries find themselves increasingly at the center of a zero-sum game. As the US and China turn to extraterritorial methods to bring partners and competitors into alignment, economies such as Mexico, Malaysia, and India are attempting to navigate increasingly strenuous demands to choose a side in both global and regional struggles. These economies will find the balancing act increasingly difficult and likely to play out on a country-by-country and sector-by-sector basis.

Bottom Line: What these changes point to is a system, interrupted in which growth is more difficult to find, policy contradictions are the norm, and the rules are being written as we go.

Within the outlook, we provide our forecasts on the year ahead across macroeconomics, global trade policy, supply chains, and geopolitics. We hope you find it helpful.

To view the webinar, please visit this page and Onyx Research to download. To inquire about customized briefings to help your team understand and navigate the shifting global trade system, please reach out to us at [email protected].

Topics: Asia, Europe, South America, North America, Trade, Industrial, Infrastructure, Economy, Elections, Manufacturing, Export, Politics, Nearshoring, National Security

Written by Onyx Strategic Insights