Search our articles

India’s New Labor Reforms Face Challenges at the State Level

Key Insights:

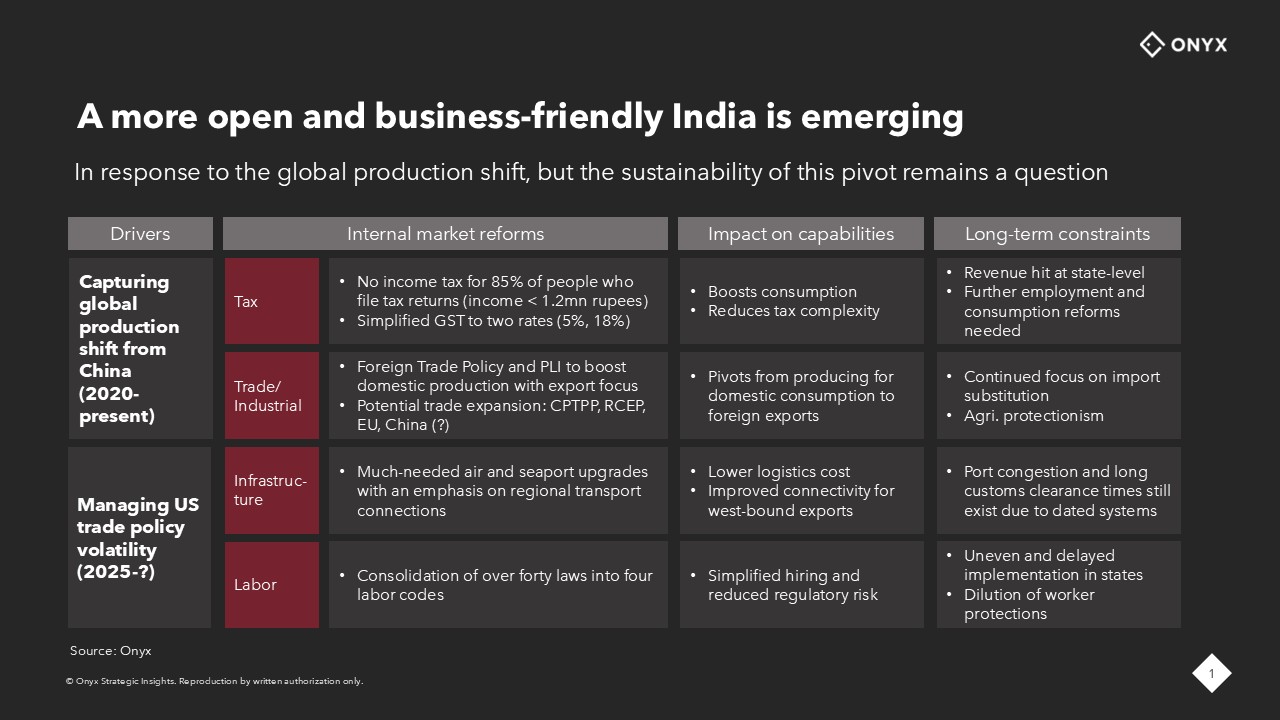

What is happening: India has notified four new labor codes aimed at enhancing workplace safety, improving ease of doing business, promoting formalization, while also aligning with global standards.

Why it matters: The labor codes reduce the need to navigate dozens of overlapping rules across states. Clear and consistent enforcement will make it easier to plan hiring, costs, and long-term investment in India.

What happens next: States are likely to move at different speeds and interpret the rules in different ways, at least at first. Companies can expect a period of uneven enforcement before the new regulatory regime settles into a more predictable national framework.

ANALYSIS

India’s four new labor codes – notified in late November – are the country’s latest reforms to improve its investment and export competitiveness. These reforms come as investors and trade partners increasingly pressure India to align its labor standards and compliance systems with international expectations. Amid trade tensions, shifting tariffs, and ongoing friendshoring, they aim to reduce regulatory ambiguity, boost labor productivity, and facilitate scalability. Their implementation also comes at a moment when the government has the political strength to push major reforms. has given the government the confidence to pursue sensitive reforms.

The main challenge though lies in state-level implementation. The Labor Ministry’s notification in November 2025 gives states 45 days to publish their own rules, with April 1, 2026 as the transition date. On paper, this creates a clear path. In practice, India’s experience with past reforms suggests the road ahead will be uneven.

Several states have already asked for tripartite discussions (involving unions, employers, and civil society groups) before establishing their respective rules. Some states – especially those with large-labor intensive industries like textiles, footwear, and auto components – fear that implementing the codes too early could raise short-term compliance costs and deter investment, especially if other jurisdictions move more slowly. This raises the risk of a familiar first-mover dilemma emerging, with no state wanting to implement rules before its peers.

These concerns highlight the prospect of the laws’ implementation following a similar pattern seen with other big-ticket reforms. For instance, India’s 2017 GST reforms were launched on schedule but went through years of rate changes and compliance adjustments. The Insolvency and Bankruptcy Code – another key reform launched in 2016 - promised time-bound resolution but quickly ran into limited capacity and lengthy legal delays. Even the Real Estate Regulation Act, aimed at protecting homebuyers, saw uneven state adoption.

The next phase then will depend on how closely states move in step with one another and whether the central government offers clear guidance on inspections, reporting norms, and wage definitions. Given that states are likely to adopt different timelines or interpretations, companies will face a period of adjustment as they assess what the rules mean in practice. The vision of a unified labor system will emerge only in stages, shaped by state-level political choices, varying administrative capacities, and recurring clarification from the central government.

Topics: India, South Asia, Asia, Labor, Industrial, Economy, Export, Manufacturing, Politics

Written by Onyx Strategic Insights