Search our articles

India's export policies advance amid rising trade barriers

Key Insights:

What is happening: India has introduced a wider set of export support measures—including expanded tax reimbursements, additional credit support and the new Export Promotion Mission (EPM)—to help firms navigate rising US tariff pressures.

Why it matters: Exporters now face a more difficult global trade environment of higher tariffs, stricter origin rules, and more intensive compliance requirements, which amplify India’s long-standing domestic hurdles such as logistics costs and fragmented regulation.

What happens next: India has implemented a host of changes to its taxation and export systems that are already having a measurable impact for companies. Nonetheless, persistent barriers and the often slow pace of change in the Indian bureaucracy will keep India behind regional competitors.

ANALYSIS

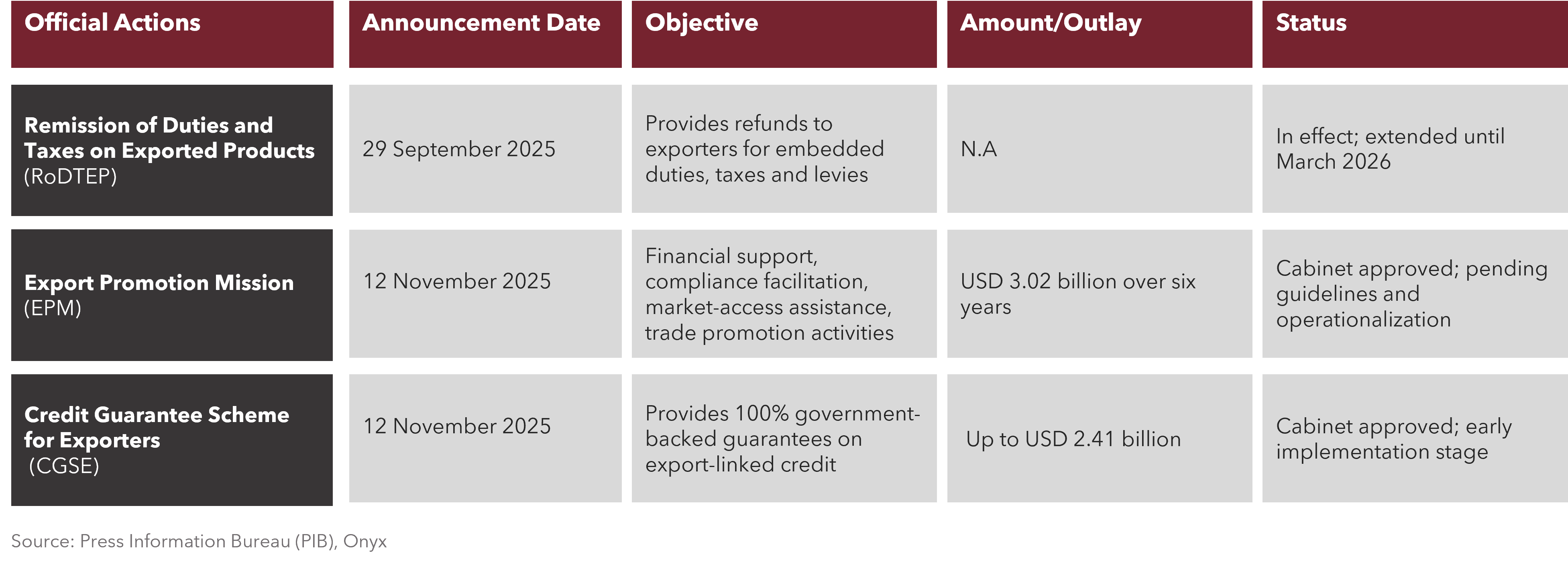

India has rolled out several export support measures in recent months to manage a more demanding external environment and the shock of higher US tariffs. To ease cost pressures, the government extended tax reimbursement mechanisms that offset embedded domestic levies. It also expanded access to export-linked credit, giving banks more room to offer collateral-free or lower collateral financing to sectors dominated by small firms, which often struggle with liquidity. Together, these measures aim to reduce two of the most persistent frictions faced by Indian exporters: cost escalation and access to working capital.

At the center of these efforts is the six-year Export Promotion Mission (EPM), which seeks to reduce fragmentation and create a more predictable ecosystem by consolidating multiple strands of export support. This matters for sectors such as textiles, engineering goods, chemicals and electronics, where firms face rising compliance requirements and tighter pricing margins. But consolidation alone cannot overcome deeper structural challenges. Export competitiveness in India is shaped by infrastructure gaps, slower port and logistics turnaround times, variations in state-level regulatory quality and firm-level differences in technology and scale. These constraints remain central to the export experience and will continue to influence outcomes even as new support measures take effect.

Looking ahead

The EPM’s impact will be shaped by how quickly it becomes operational and how effectively it connects with broader reforms in logistics, standards, and administrative efficiency. India’s track record suggests that such missions take time to gain traction across central and state systems. While the EPM marks an important step, it will not, on its own, bring India in line with export environments such as Indonesia’s, where procedural and logistical pathways tend to be more streamlined. Indian exporters may see incremental improvements, but broader competitiveness gains will depend on parallel progress in ease-of-export reforms.

Topics: South Asia, India, Trade, Industrial, Economy, Manufacturing, Export

Written by Onyx Strategic Insights