Search our articles

What the U.S. reciprocal tariff push means for South Asia

Key Insights:

- What is happening: threaten South Asia’s key exports to the U.S.—especially from Bangladesh, India, and Pakistan—by raising costs on labor-intensive goods. Despite a 90-day pause for negotiations, the threat exposes these economies to heightened risk amid already fragile conditions.

- Why it matters: Reciprocal tariffs are eroding South Asia’s cost advantage in labor-intensive exports, making sourcing more expensive and less predictable for global businesses, while rising uncertainty is deterring investment and heightening economic instability—particularly in politically fragile markets like Pakistan and Sri Lanka.

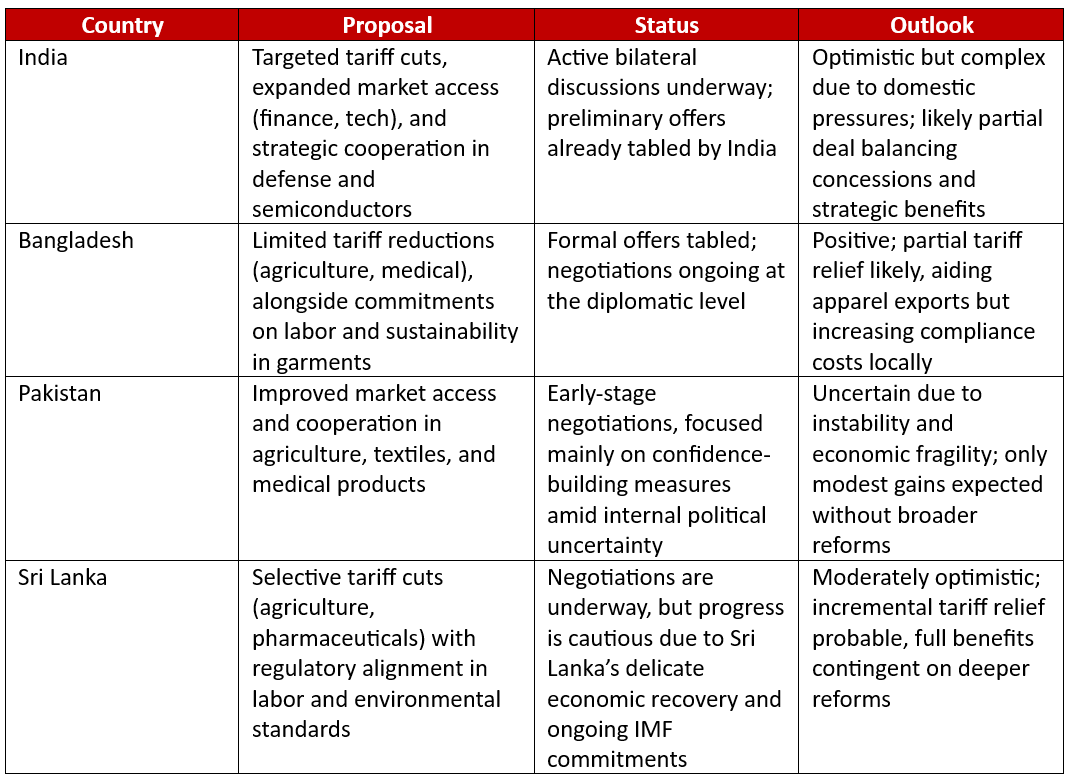

- What happens next: To preserve critical access to the U.S. market, South Asian countries are preparing a range of concessions—including tariff reductions, expanded market access for American firms, strategic sector cooperation, and regulatory reforms—but each move comes with significant economic costs to local industries and potential political backlash from domestic constituencies.

ANALYSIS

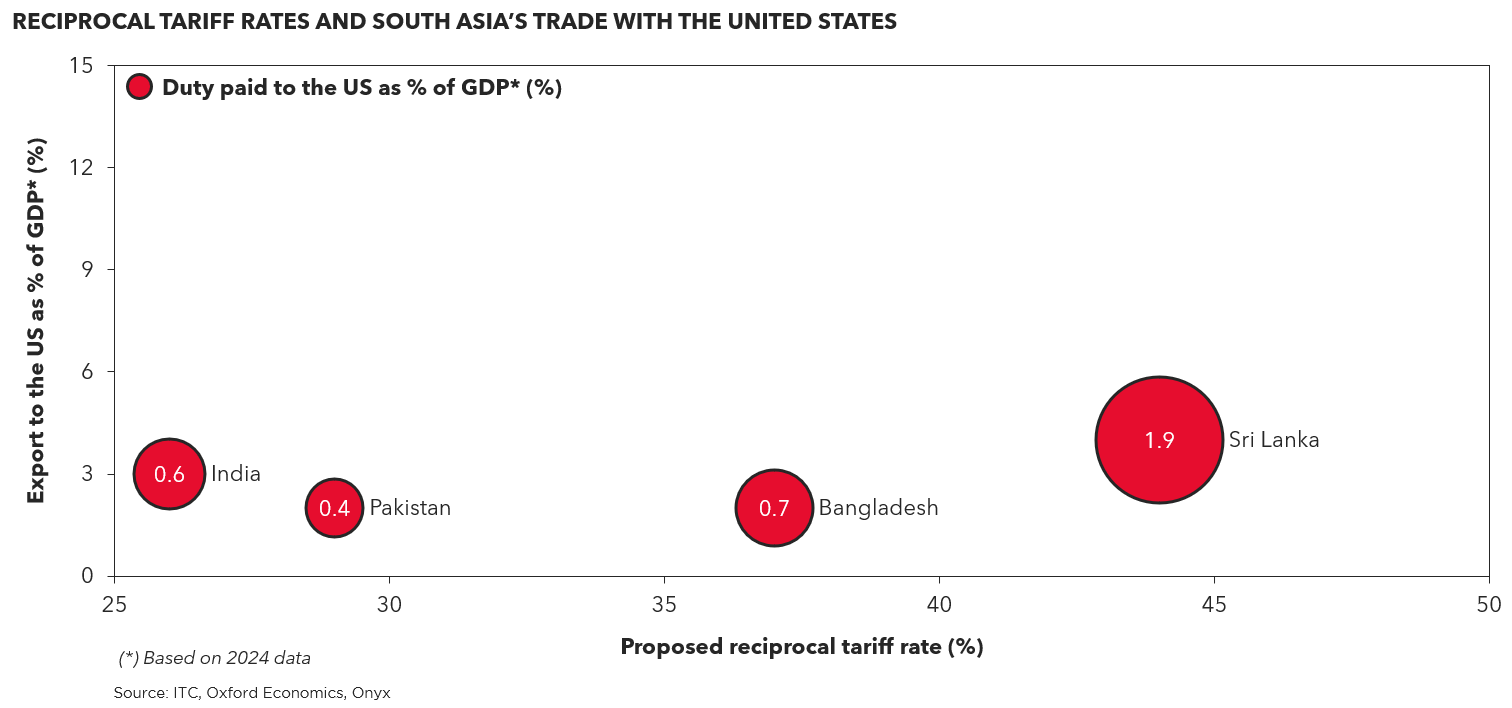

The trade imbalance comes under fire

India and Bangladesh have long maintained trade surpluses with the U.S.—Bangladesh as a major apparel exporter, and India through pharmaceuticals, machinery, and software. U.S. exports to these countries often face higher tariffs or market barriers, prompting Washington to propose reciprocal tariffs ranging from 26% to 44% on imports from India, Bangladesh, Pakistan, and Sri Lanka. If enacted, these and other tariffs could severely impact key sectors—apparel and textiles in Bangladesh and Sri Lanka, textiles and pharmaceuticals in India, and cotton in Pakistan.

Cost advantages begin to crumble

South Asia’s comparative advantage—anchored in low labor costs—by the reciprocal tariff framework, which can raise landed costs in the U.S. by 10–20%. Moreover, a potential 10–25% tariff on pharmaceutical imports under a Section 232 investigation by the U.S. Department of Commerce could strain India’s pharmaceutical exports, as higher costs and added regulatory scrutiny may push U.S. buyers to seek alternative suppliers.

Beyond immediate cost impacts, the uncertainty surrounding tariff threats is chilling investment sentiment. Global brands are rethinking their sourcing strategies, with some eyeing markets with lower U.S. import tariff. This shift in confidence could trigger broader economic consequences—job losses, slower factory output, and reduced export revenues—posing fiscal risks, especially for Pakistan and Sri Lanka, where fragile political environments and IMF-backed reforms leave little room for external shocks.

What happens next: concessions and calculated risks

Negotiations, backed by targeted concessions, will likely be the next step. None of these countries can afford to be locked out of the U.S. market nor pay extravagant duties. But the path to compromise is complex, with real economic and political trade-offs.

Topics: South Asia, Trade, Labor, Industrial, Manufacturing

Written by Onyx Strategic Insights