Search our articles

Countries caught in the middle of tariff negotiations with the US

Key Insights:

What is happening: The Trump administration is pressuring its trade partners to reduce their economic and tech dependences on China in exchange for lower tariffs. China warned it would retaliate against trading partners who hurt Chinese interests in attempts to “appease” the US.

Why it matters: Third countries will be pushed to choose economically, with the threat of punitive measures from either their largest supply or demand market. The prospect of either Chinese retaliation or high US import tariffs will disrupt growing investment in these third markets, impacting their resiliency as alternative production bases.

What happens next: Diversifying away from China as an investor, trading partner, and sovereign lender will be challenging for emerging markets due to the lack of viable alternatives. Should China retaliate, it will likely target countries surgically through existing lending, export controls, and pauses to ongoing investment projects.

ANALYSIS

As the July 9 deadline for the resumption of reciprocal tariffs nears, negotiations between US trading partners and the Trump administration have kicked into high gear. Seeking to isolate the Chinese economy, the Trump administration has pressured its trade partners to limit their economic ties with China as a condition for reduced tariffs. US officials have pushed Vietnam in particular, to reduce its dependency on Chinese high tech including tech components in onward exports to the US. This scrutiny of Chinese content in other countries’ exports is expected to be a consistent and long-term policy focus in the Trump administration’s trade policy.

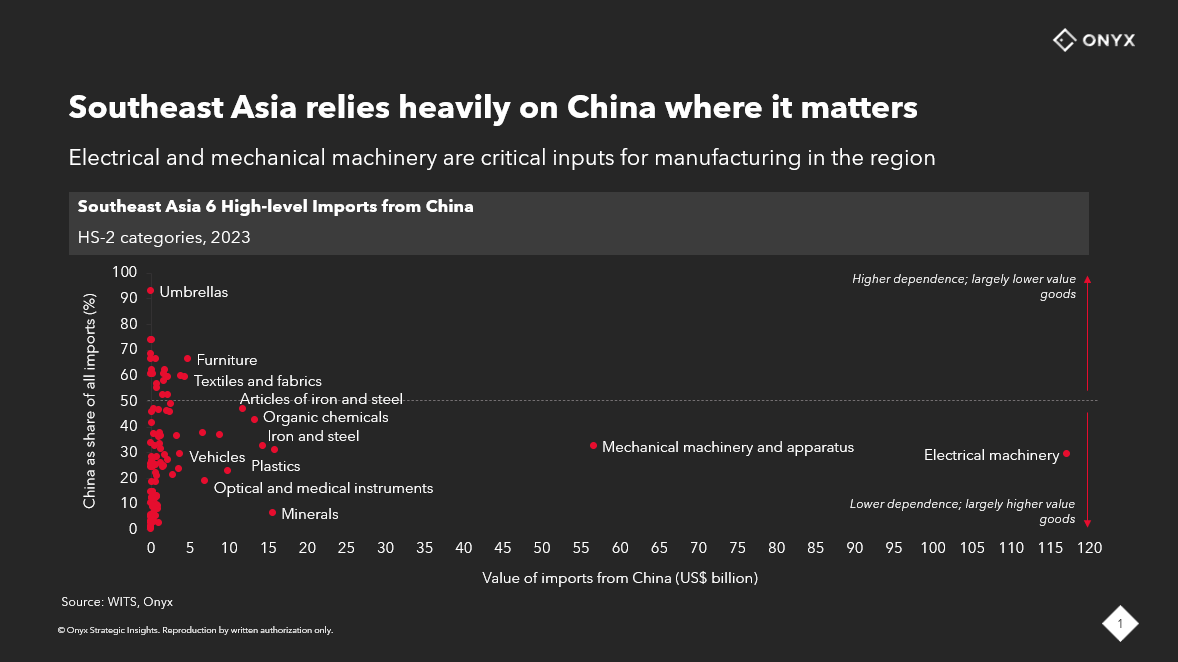

Yet, even if third countries accede to US demands, they may find scaling down economic ties with China challenging. Southeast Asia for instance, is still highly dependent on China where it matters – in critical manufacturing inputs, even if it may make progress in diversifying supply sources for other lower-value goods (see Figure 1).

In response, Beijing has warned third countries that it would retaliate against those who seek to appease the US for lower tariffs. This dynamic places third countries in a difficult position of choosing between supply and demand risks – if they strike a deal with the Trump administration and preserve access to US demand, they could face supply risks from China’s retaliation through upstream supply chains and vice versa.

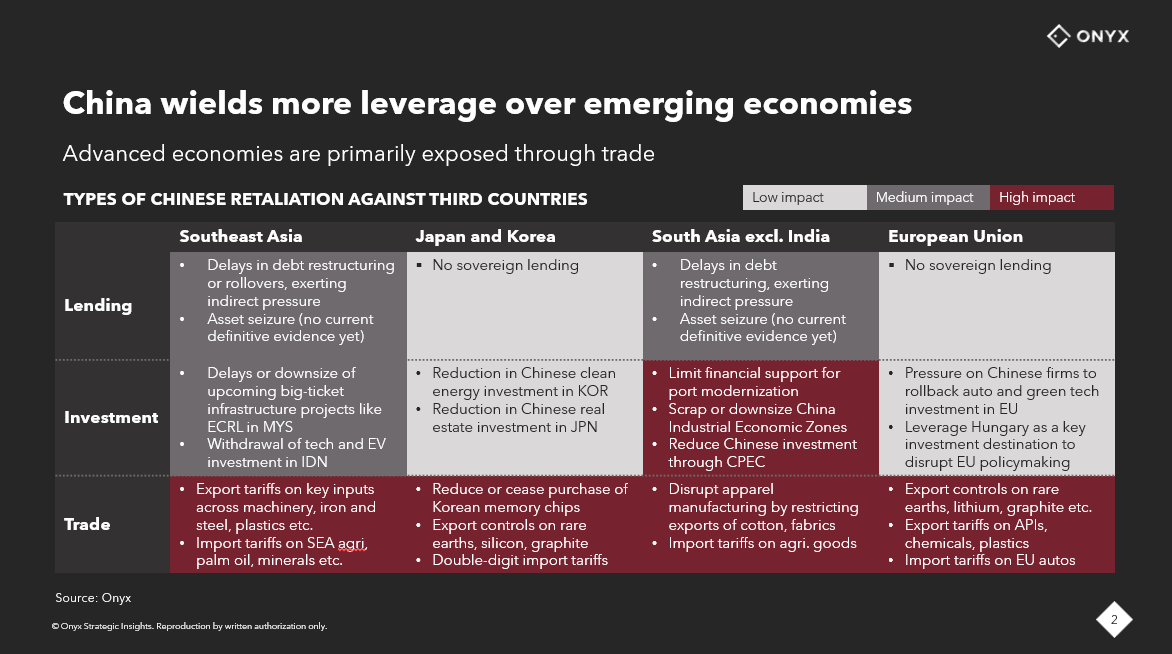

Emerging economies are more vulnerable to Chinese retaliation than advanced economies, as China can wield more leverage across lending, investment, and trade. Beijing may opt to target South Asia and Southeast Asia through non-trade measures to avoid further weakening its export performance, while preserving trade retaliation for advanced economies (see Figure 2). For instance, China’s rare earths export controls are highly surgical, allowing officials to approve licenses for select American and European firms/industries at various speeds. This limits overall economic fallout, while being effective in exacting pain.

The prospect of choosing between Chinese retaliation or high US import tariffs injects substantial uncertainty into investment plans in these third countries and will impact their resiliency as alternative production bases. As multinationals play catch up with US trade regulations, foreign investment may again shift to countries that are committed to diversifying supply chains, reducing single-source/origin goods, and balancing between competing US and China demands. For now, India, Japan, Singapore, and Australia appear to be likely contenders.

Topics: North America, Southeast Asia, China, Trade, Manufacturing, National Security

Written by Onyx Strategic Insights