Search our articles

China’s export shift from the US will reshape global markets unevenly

Key Insights:

- What is happening: The US-China trade war has sparked concerns that a large-scale redirection of cheap Chinese exports to other markets would undercut prices in advanced economies and stifle the growth of new manufacturers in developing countries.

- Why it matters: However, redirected exports constitute only a small share of China’s total global exports and are concentrated in only five industries – batteries, auto, computers, plastics and toys. Advanced economies competing in these sectors will take the brunt of the impact but developing economies do not face a direct challenge from a redirection of these goods.

- What happens next: The more critical issue for developing economies is longer-term competitiveness challenges due to China’s industrial policies rather than immediate export redirection, particularly as China doubles down on expanding its trade ties beyond the US.

ANALYSIS

Recent trade and shipping restrictions placed by the Trump administration on China have significantly reduced Chinese exports to the US. In response to the decline of a key consumer market, China has doubled down on its long-term efforts to diversify the country’s trading partners, particularly in the Global South. These diplomatic and trade outreaches have long preceded the Trump administration’s actions and will persist even if both powers reach a deal, foretelling the potential redirection of China’s exports to the rest of the world. This has raised concerns that a sudden redirection of Chinese exports would hurt manufacturers in both advanced and developing markets, undercutting prices in the former and pushing out fledging manufacturers in the latter

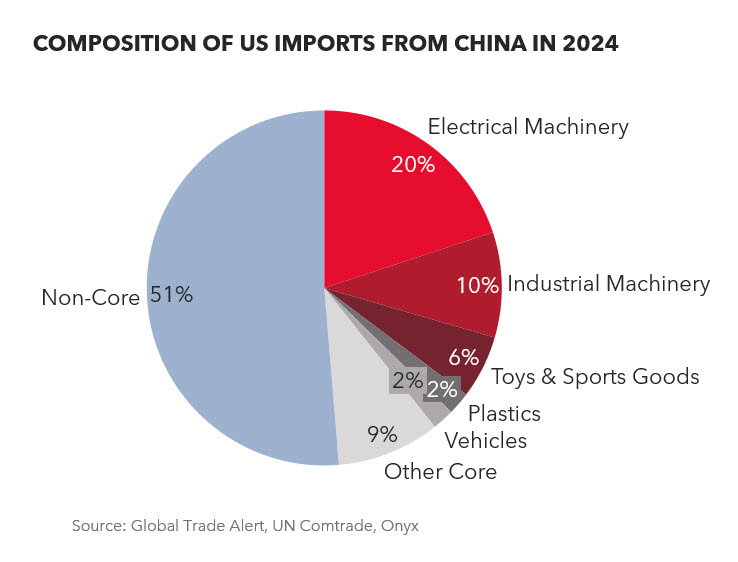

Our analysis suggests this concern is valid for certain “core” sectors; however, a redirection of “non-core” Chinese goods could be absorbed globally. For example, roughly half of Chinese exports to the US are concentrated in 101 core product categories that exceeded US$500 million in 2024, totaling about US$213 billion. These 101 product categories were primarily battery, computer, motor vehicle, plastic, and toy exports. Disruption in core industries would be significant, given their relative importance in European and East Asian economies, though the major impact remains concentrated in these five sectors. Other non-core Chinese exports to the US (another $213 bn) are diffuse across thousands of product categories. Even if all those exports were redirected, it would amount to less than 1% of imports by the rest of the world (excluding China and the US), an amount to which we think the global economy could adjust.

These trade patterns point to the highly uneven impact that a redirection of Chinese exports pose across geographies and industries. In advanced economies that compete in these same core sectors – batteries, auto, electronics – the surge in more price-competitive Chinese goods will pose concerns for domestic manufacturers and potentially undercut economic growth if these sectors are significant sources of revenue and employment. However, for other developing economies that are still focused on primary sectors or lower-level manufacturing, redirected Chinese exports from the US pose less of a systemic challenge to domestic producers. Instead, the more pressing concern for developing economies is China’s long term industrial policies that reduce labor costs in skill-intensive industries and undercut the competitiveness of these sectors in other middle-income economies.

Topics: China, North America, Asia, Trade, Industrial

Written by Onyx Strategic Insights