Search our articles

A vision of US foreign policy?

Key Insights:

- What is happening: US President Donald Trump has started a fundamental rethink of US alliances in pursuit of a more economically beneficial alliance structure. At the same time, he looks for support to remake the global trading system and China's role in it.

- Why it matters: The US gamble to reshape its alliance system and potentially box out China or other countries with trade imbalances will have implications across the supply chain. Geopolitical divides create a topography for supply chains to navigate, entailing higher costs, lower reliability, and greater risks.

- What happens next: The simultaneous approach on alliances and China has undermined US leverage, goodwill, and reliability. While countries will still choose to work with the US, it will likely struggle to bring partners into its maximum leverage approach that may well turn into decoupling.

ANALYSIS

End of the consensus

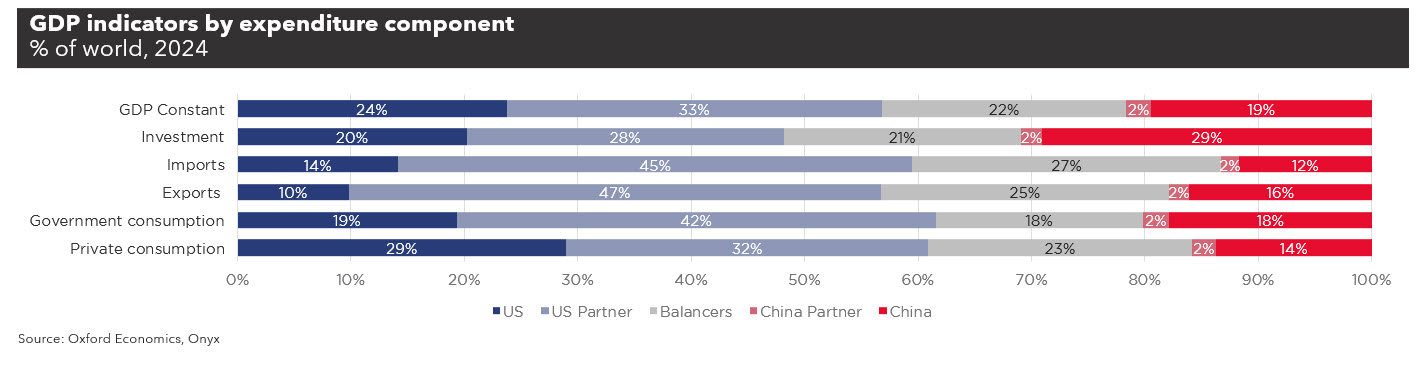

The US foreign policy consensus, a set of widely shared beliefs about how the US can best navigate global affairs, included the use of free trade and defense pacts as foreign policy inducements in the US pursuit of allies and soft power. This allowed for a spectrum of approaches, but also some stability. Due in part to this structure, US leverage in the international system has remained highly relevant even as China’s share of global investment, trade, and government consumption have grown to match or exceed that of the US.

The consensus has faltered with the sheer scale of Chinese productive and trade power, rising uncertainty about relative US military capabilities, and rising economic inequality in the US. These trends have pushed portions of the Republican party into a focus on the US industrial base. This in turn has increasingly come into conflict with the US approach to forging new partnerships. Examples include US disengagement from the Trans-Pacific Partnership and limited trade concessions for Indo-Pacific Economic Framework for Prosperity members. Now the Trump administration has initiated a more significant step back, particularly from the EU.

“... the US approach has reduced its leverage and support even as President Trump looks to use it as his primary tool”

—

De-risking from the US

With that, the US has set off a scramble to de-risk from the US. In the EU, tensions with China have cooled as both countries look to keep their options open. Meanwhile, the EU has focused more intently on its own industrial base, stimulus to cushion the potential blow, and defense spending as the world enters “an era of rearmament.” In other words, the US approach has reduced its leverage and support even as President Trump looks to use it as his primary tool.

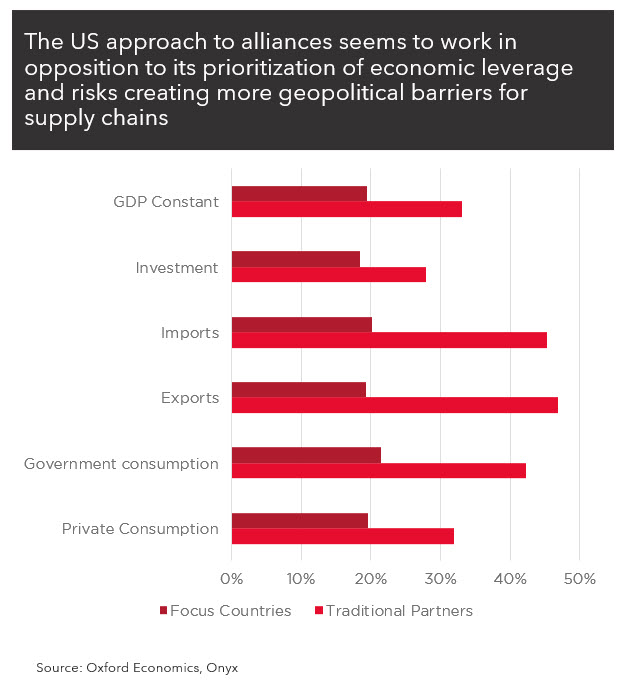

There are indications that the US is looking, post-April 9th pause, for a slimmed down approach, prioritizing Mexico, Canada, the UK, India, Taiwan, and Japan in discussions while the EU has been largely left on the sidelines. Statements and reports have indicated that the US administration may be looking to take on global trade imbalances broadly or to create leverage versus China specifically. This would face many hurdles that range from the practical ability to replace China’s intermediate inputs to the strategic considerations of each country. But there is also a concern that Trump, a nationalist at heart, may struggle to make credible promises about how allies would fare in future America First pushes and in future US administrations.

These trends of diversification, self-sufficiency, and realignment will take time to play out as countries adjust to the new realities. Agreements with strong reassurances from the US will also take considerable time. While the world is realigning at the speed of capital expenditure, the US has taken on a maximalist negotiating position versus China that will have heavy domestic US economic implications that risk the Trump administration’s ability to negotiate.

Topics: North America, China, Europe, Trade, Politics

Written by Onyx Strategic Insights